We make it possible

Financial needs.

simply human.

Fulfilling financial needs

Our mission

We believe that everybody should have an easy and reliable way of fulfilling their financial needs and we use our technology to make it as simple and convenient as possible.

Fulfilling financial needs

Our mission

“We believe that everybody should have an easy and reliable way of fulfilling their financial needs and we use our technology to make it as simple and convenient as possible.” ![]()

simple and understandable

what do we do?

We provide available means of financing our customers’ plans in the most simple and understandable manner.

scoring models & algorithms

We rely on technology

We digitized the entire application process to make it accessible for our customers. We rely on technology to perform seamless credit assessments and deliver the funds to our customers as quickly as possible but we are also human so you can reach us anytime.

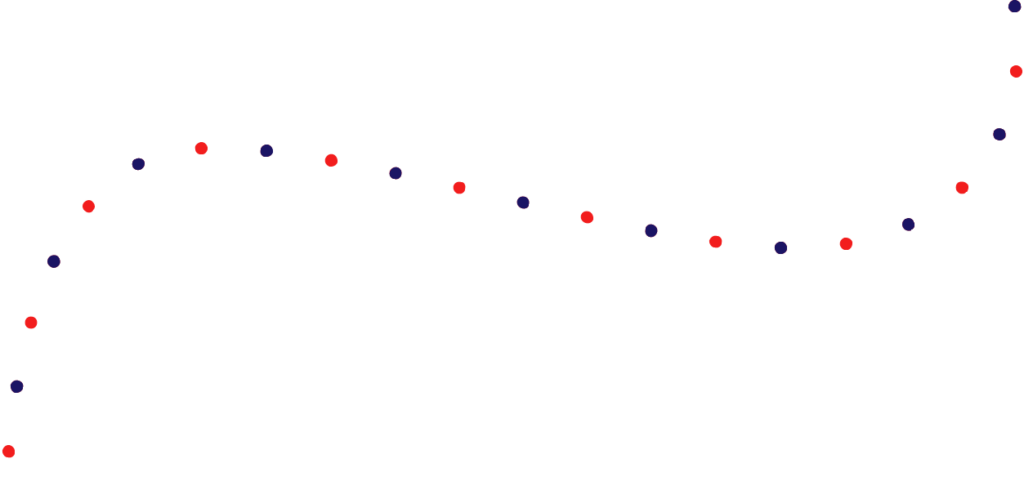

AvaFin utilises sophisticated customer scoring models and machine-learning algorithms to ensure an automated underwriting process and to secure excellent loan performance.

We are a highly technology-focused company with strong risk management and IT development teams.

Across the world

We are a global company

Cross-Cultural Cooperation

Employees

Countries

Friendly Environment

We are a

fintech company

We are offering a state-of-the-art consumer financial solution technology to provide convenient loan products with minimal time to cash.

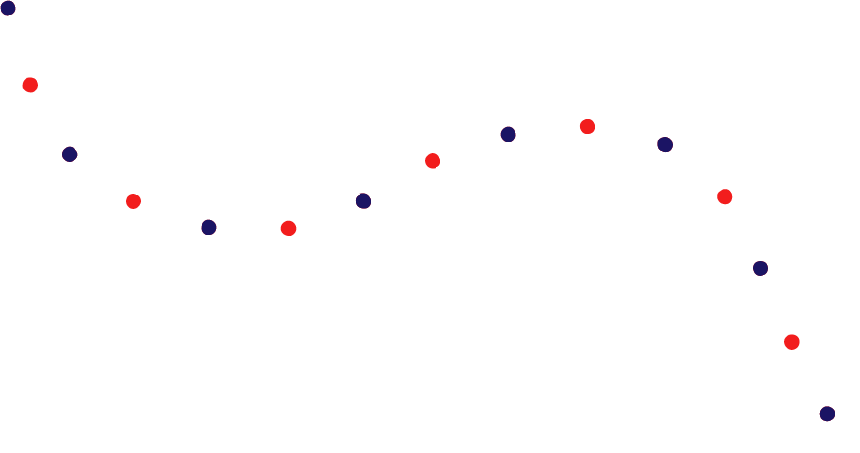

Share of consecutive loans in 2022A

Markets

Unique clients served

Number of loans since foundation

We are one of the most trusted

Online Lenders

We have provided consumer loans for over 10 years and issued over € 1,25 billion in principal.

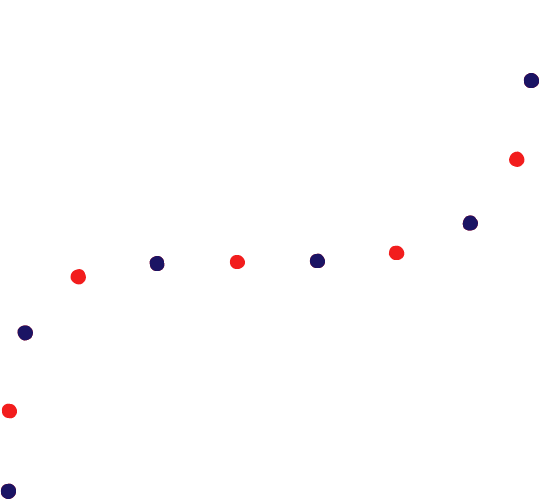

During the covid crisis

we demonstrated strong resilience

We demonstrated strong resilience during the COVID crisis, by increasing it’s net loan book by 16%, maintaining revenue levels in 2020. While drastically improving profitability in 2021 and achieving record high profits.

In 2022, we set a new net profit record, reaching 8.3M, with a profitability margin continuously improving.

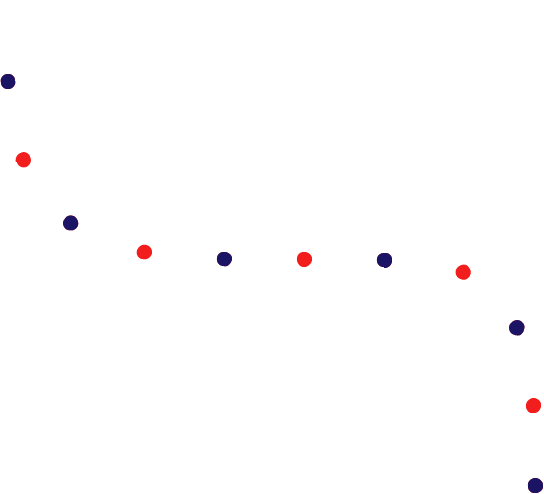

EBITDA

loan book (per Dec 22)

Return of Equity

average loan size in 2022